In the earliest days, economic advantages were rooted in tangible property like real estate, personal property, or different forms of natural resources. There has been a shift in this paradigm with the introduction of the modern-day economy, which has garnered almost every country’s economic progress based on Intellectual Property Rights (IPRs) through information embedded products and services like pharmaceuticals, computer software, databases, films, musical works, broadcasts of sporting events, and brand names. Understanding the potential of these resources is very crucial for the growth and development of any economy, which may occur through securitization. Securitization is a beneficial financial tool that is backed by future income channels, which have the capacity to grow as a leading source of financial gains.

What is Securitization of Intellectual Property Rights?

The securitization of IPRs enables the capitalization of the intangible assets to accrue predictable channels of royalties, which can help finance business operations. The same, therefore, decreases the dependency on bank credits and creates a cushion against any financial loss. Hence, it helps to diversify the interest of an entity procuring creativity and innovation. A few famous examples of securitization of Intellectual Property (IP) assets began to be witnessed right after the mid-1990s in the form of copyright held by singer David Bowie, the Trademark Rights over the franchises held by Domino’s Pizza, and the Patent Rights over the HIV drug prepared by the Yale University.

The term has been defined by the Reserve Bank of India as:

“Securitization is the process of pooling and repackaging of homogenous illiquid financial assets into marketable securities that can be sold to investors.”

To be specific, it is a practice whereby the future cash flow of an entity from an IP asset is used in the form of a guarantee for the repayment of its debts. Therefore, it helps to create the funds before actually receiving the payment due in the future.

Parties to the Procedure of Securitization

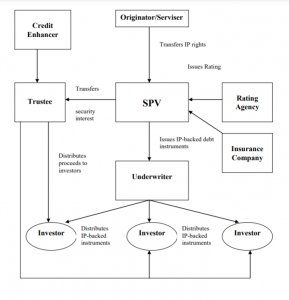

- The Originator: The originator is usually the bank in the case of non-IPR assets, but for IP assets, it is the company that owns the said asset, which is to be securitized, i.e., being financed to the investors through an indirect mechanism. It is the originator that transfers the assets to the SPV, which it creates on its own.

- The Special Purpose Vehicle (SPV): It is created by the originator to transfer the IP assets instead of the funds, which the SPV provides to the originator. The SPV raises the previously mentioned funds from the investors in return for the IPR assets by issuing IP security backed instruments, or it can also create a Trust. Although it is created by the originator, it is a separate legal entity.

- Investors: These are those people who wish to invest money in the said IPR asset. They pay the SPV the amount, which is specified in the negotiable instruments in return for the IPR asset-backed security in addition to an interest rate. The same money is then used to replay the originator. It is usually performed by insurance companies.

- Servicer: It is the authority that takes care of these assets during the process of securitization concerning their payment and collection of annuities, royalties, taxes, etc.

- Trustee: The Trustee is the one acting as a connecting link between the investor and the SPV or the Trust. It is a stalwart of the investors as it protects them by ensuring that the transferred assets are free from any claims or liabilities.

- Rating Agency: It evaluates the level of risk the particular security backed by such assets hold by giving ratings to the debtor. The rating is an indicator of the ratio of cash flow that would come after the securitization of IPR assets by analyzing uncertain future events as well.

- Credit Enhancer: As seen above, the rating agency provides for ratings. These ratings can be boosted if the IP is credit enhanced, and it would thus, attract more investors. Credit enhancement reduces the losses, which an investor may incur in the face of unstable IP performance.

The Process of Securitization

The procedure of securitization is such that it facilitates the holder of the IP asset (also known as the originator) to sell the asset to an SPV. This SPV creates the marketable security, which is back by the IP asset of the originator (asset-backed security), which is then sold to the investor in the capital market. Therefore, it is appropriate to say that it helps convert an illiquid asset that cannot be readily sold or exchanged without sustaining a substantial loss in its value into a marketable security. The same is against the background, where only tangible assets like physical properties were the assets used to back such securities. However, today it is possible to have IPRs, which could be used to back securities that help in funding.

The entire procedure is summarized as follows:

- Where an IP asset is assessed by a company holding it that it is capable of generating cash flow, the process of securitization is initiated by the originator.

- The originator then makes an SPV and sells his assets to it.

- The SPV then creates securities backed by IPR assets, which can be offered to investors. An alternate route of creating a Trust can also be taken up by the SPV by transferring the assets to the Trust itself, which is taken care of by the Trustees. Here the Trustees are responsible for the securities to make the sales to the investors.

- The credit rating agency offers it ratings which act as advisory pointers for investors.

- Then the investors either approach the Trustee or the SPV directly to buy the securities in place of the money given to the SPV/Trustee.

- Lastly, these funds, which are raised by the SPV or the Trust, are used to pay back the originator that initially issued the IP assets.

Why Should an Entity Consider Securitization of its IP Assets?

- As has been discussed above, it is an additional mode of generating income. An entity can strategically utilize the tangible and intangible assets held by it to enable securitization at a mass level.

- While tangible assets require greater interest rates on security back by the SPV, the interests of intangible assets are generally lower, which helps raise funds cheaper in nature. The same, however, depends on the rating a particular IP asset’s back security has received.

- It can help make up for any losses or need of funds that may be needed to cure debts, introduce expansion projects, or for R&D activities since it substitutes the future receivables in the form of royalties with current existent cash.

- In the notion that credit ratings are extended to rate the securities, there is an element of mutual trust, respect, and transparency between all the actors involved in the process. Hence, it helps raise money while also build trust and confidence amongst the existent and potential investors.

- It also helps in providing liquidity to the firm as the illiquid assets get readily converted into capital market securities.

- Since such a transaction is considered as a loan and not a sale under the premise of the law, it is excluded from being taxed.

- Since the IP is not subjected to sale, there is no transfer of ownership rights. The same results in the entity being able to exploit and maximize the generation of funds through the application of this financial strategy.

Problems Incurred During the Securitization of IP Assets

There are a few issues that arise during the securitization of IP assets. The same are mentioned below:

- Securitization of assets requires bearing the costs, which would include payments to be made to law firms for IP valuation, to the accounting firms, etc. Therefore, the IP asset should be capable of sizable returns to make good of such expenditures incurred.

- The value of the IP right is enforced after receiving the requisite rating. However, in certain instances, there are trade secrets, some know-how, or confidential information attached to the assets, which may not render it valuable when viewed by a common man acting as an investor.

- The entire transaction is based on a predictable cash flow in the future. Where the cash flow is doubtful or not sizable, such a step may not be the right one.

- The term of securitization runs parallel to the term of IPR. Therefore, the same should be taken into consideration while opting for such a financial strategy.

Concluding Remarks

The concept of securitization is new to the realm of IPRs when compared to the securitization of tangible properties. The same conceptually changes the idea of what constitutes an asset and how it can be realized to maximize the financial outputs. It also helps the originator to avoid bank formalities and yet generate optimum funds. This financial strategy can help not just big entities but also small startups that have no substantial tangible assets but do hold valuable IP assets to help in their expansion. However, a major problem lies in the manner of valuation of IP assets as there are different and conflicting models of valuation, which may introduce the problem of actual determination of future outcomes.